REVIEW OF MATH

2.2 Multivariate calculus refresher

The part of these notes addressed functions where a single input goes in, and a

single

output comes out. Most economic applications aren’t so simple. In most cases, a

number of variables influence a decision, or a number of factors are required to

produce some good. These are functions of many variables. If the variable

z is a

function of x and y, this is written:

z = f (x, y)

Of course, f could be a function of more than two inputs. A production function

might have capital, labor, and material inputs:

Y = F(K, L,M)

Utility might be a function of  goods:

goods:

Demand for a particular good

is a function of the price of that

good, the price of

is a function of the price of that

good, the price of

another good  , and the person’s wealth:

, and the person’s wealth:

In previous micro classes, you discussed about how

quantity demanded changes

when something else, like the price of  ,

changes, “holding everything else constant”

,

changes, “holding everything else constant”

or ceteris paribus. This translates into the idea of a partial derivative,

denoted by:

The price of good x is held constant, and wealth is held

constant—though the

person’s wealth may change if he is a large producer of good y, we’re not

concerned

about those possible effects. Similarly, we might talk about the marginal

product of

labor (denoted by  or simply

or simply

), and the marginal utility of

), and the marginal utility of

consuming good  (denoted by

(denoted by

).

).

Taking a partial derivative  is like

pretending f (x, y) is just a function of x,

is like

pretending f (x, y) is just a function of x,

with y constant. Because of this, the addition rule, the product rule, and the

quotient rule work the same as in the univariate case.

Considering that other factors may change is the notion of a total derivative.

Using the previous example, consider that demand for x is a composite function

of

prices and wealth, which is itself a function of prices:

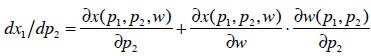

Then the total derivative of x with respect to the price of y is:

The first term on the right-hand side is the partial

derivative of x with respect to

price of y. This tells you the effect holding everything else constant. For the

total

derivative, we also add in these other effects—in this case, that the person’s

wealth

changes when the price of y changes, and that his demand for x changes when his

wealth changes. The second term on the right-hand side comes from applying the

chain rule. Intuitively, the partial derivative

captures the substitution effect

captures the substitution effect

of a price change, while the total derivative  contains both the substitution

contains both the substitution

and income effects.

Similar to derivatives are differentials. Remember that, given a change

in the run

of a function (back to one variable) you can use the slope at that point to

approximate the change in the rise:

When the Δx get really, really tiny this is a good

approximation. When they get

infinitely tiny or infinitesimal, this turns out to be exactly

correct, not an

approximation at all. The convention in calculus is, of course, to use dx to

denote

this small change:

This is known as a differential. If you divide both sides

by dx, you get the derivative.

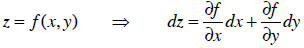

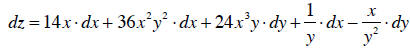

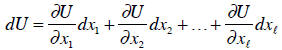

In multivariate calculus, a function and its differential might look like:

The way that I figure out differentials is by writing down

a list of all the variables

(dependent or independent) and then going through the function. Whenever a term

shows up that has one of these variables, I take the partial derivative of that

term

and I tack on a dx or whatever the variable is. If the term has multiple

variables in it,

I do this for each of them. Consider the relationship:

The differential of this function is:

If we say y doesn’t change, and we want to see what the

effect of a small change in x

on z is, we set dy = 0 . Not surprisingly, the result is exactly the same as the

partial

derivative of z with respect to x. Additionally, we might be interested in

changing

both x and y a small bit, and see the result on z. We can also do this using the

differential.

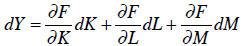

Differentials are more versatile than just taking the derivative. Let’s say we

have the

production function:

Y = F(K, L, M)

where capital, labor, and materials are our inputs. The differential of this

production

function is:

That equation says that the change in output depends on

the change in capital and

the marginal product of capital, the change in labor times the marginal product

of

labor, and the change in materials times the marginal product of materials.

That’s a

true, indisputable fact.

We can use that fact in the following manner. Suppose we want to keep output the

same, and see how much less of one factor (capital) we would need if we reduce

another (labor) from the same materials. In other words, we want to keep dY = 0

and dM = 0 , and we need to find the values of dK and dL that balance the

equation:

With some rearranging, this produces the following result:

This is change in capital necessary to keep production the

same. In economics, it is

interpreted as the marginal rate of technical substitution. If you

remembered

from previous classes that the MRTS of labor for capital is the ratio of their

marginal

products, you’ve now seen where that result comes from. What we have found here

is the slope of the isoquant curve at a particular point.

Another interesting question would is how much of one good a person would

require

to offset in utility changes from a change in another good. Let’s say there are

l

goods, labeled ![]() through

through

, in the person’s utility function:

, in the person’s utility function:

The differential of this function is:

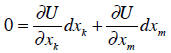

We want to know how much of good k the person would trade

for good m, keeping

his utility the same. He is not trading another other goods. Then:

Rearranging produces the marginal rate of substitution:

Again, you may recall that the MRS equals the ratio of

marginal utilities. It should

also be the slope of a line tangent to the indifference curve at that point.

Think

about this in a two-good world—draw some pictures in

space. If we start

space. If we start

with a particular point and name all others points which do not change the

utility—

that is, the set of all points such that dU=0—we’ve identified an indifference

curve.

Its slope at this particular point would be described by

, which is exactly

, which is exactly

what we found here.

Indifference curves and technology frontiers are both examples of implicit

functions. An explicit function is what we usually think of as a function:

y = f (x)

An implicit function looks like:

c = f (x, y)

where c is some constant (or at least a constant, as far as we’re concerned).

Think

about indifference curves and isoquant curves, which show the values of x and y

that

yield the same utility or output c: these are implicit functions.

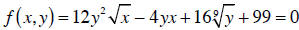

Sometimes we get a relationship between x and y that’s

virtually impossible to solve

for one in terms of the other. For instance, try solving this for y:

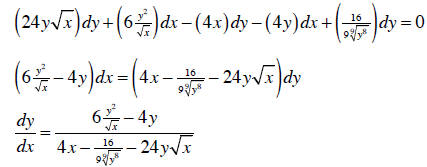

Given that you can’t isolate y, is there any hope of

figuring out dy/dx ? Yes, using the

differential as before:

The point is that even if you can’t solve y explicitly in

terms of x, you can still

evaluate its derivative.

More importantly, often you don’t even know the exact function (because you’re

working with an arbitrary U(x, y) ), which makes it impossible to solve

explicitly for

one variable in terms of another. You can still look at marginal effects, as we

did

earlier. These are all applications of my favorite principle in mathematics, the

implicit function theorem.

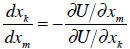

Theorem: Let f (x, y) = c implicitly define y as a function of x, for

some constant c. Then

the derivative of y with respect to x is

This is very useful in economics. For instance, consider a

person who gets utility

from consumption of two goods, x and y. We’ll set the price of the first good to

1,

and let p be the price of the second. The budget constraint requires

that y = (w - x) /p . Substituting this into the utility function, we have that:

The utility function is:

U(x, y) =U(x, (w - x) /p)

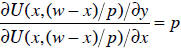

We usually find that a utility maximizing individual sets the marginal rate of

substitution between the goods equal to the relative prices:

How does a change in the price (or wealth) affect

consumption of x? One side of the

equation needs to be a constant, which can almost always be achieved by simply

subtracting one side off. It also looks like we can make things simpler by

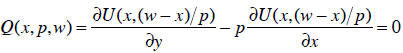

multiplying

through by the denominator. Let’s give this implicit function the name Q:

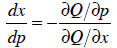

The implicit function theorem tells how to find all of

these effects; for example, we

can use this function to determine how demand changes when prices change:

The neat thing about this is it gives us an answer that

depends on diminishing

marginal utilities of the goods (second derivatives) as well as their

complementarity

or substitutability (cross-partial derivatives)—and we’ve assumed nothing about

the

utility function.